Proposed Rule: The Enhancement and Standardization of Climate-Related Disclosures for Investors

The Securities and Exchange Commission (SEC) announced long-awaited guidance that will add climate reporting requirements to the list of disclosures for publicly traded companies. The proposed rules allow for a 60-day comment period and would go into effect following a phased approach starting in 2023.1

SEC Chair Gary Gensler commented on the role the organization plays in helping investors make investment risk decisions,2 “Today, investors representing literally tens of trillions of dollars support climate-related disclosures because they recognize that climate risks can pose significant financial risks to companies, and investors need reliable information about climate risks to make informed investment decisions. Today’s proposal would help issuers more efficiently and effectively disclose these risks and meet investor demand, as many issuers already seek to do.”

What does this mean for you?

Governance of Climate Risk: All publicly traded companies will be required to state the degree of risk related to climate change within its current business and operational model. If a company defines climate risk as material, it will be required to report the nature of the risk, and its plans to mitigate risk related to its climate and performance data. This will be required annually in the 10-K filing.

All publicly traded companies will need to conduct climate scenario planning. There’s no rule yet on how often, however, this is how a company will determine the degree of risk they face.

ESG Data Requirement: Companies will be required to publish Scope 1 and 2 emissions annually. Additionally, if it resides in a “material” risk industry—a company will also have to disclose Scope 3.

Governance of ESG Data:

- Public companies above a certain market cap threshold will be required to audit and 3rd-party verify climate-related performance data reported in 10-K filings annually.

- 10-K statements will also require that the company outline climate-related targets, goals, and transition plans, if any.

For explanatory purposes, the following tables assume that the proposed rules will be adopted with an effective date in December 2022 and that the filer has a December 31, 2022 fiscal year-end:

| Registrant Type |

Disclosure Compliance Date |

| |

All proposed disclosures, including GHG emissions metrics: Scope 1, Scope 2, and associated intensity metric, but excluding Scope 3 |

GHG emissions metrics: Scope 3 and associated intensity metric |

| Large Accelerated Filer |

Fiscal year 2023 (filed in 2024) |

Fiscal year 2024 (filed in 2025) |

| Accelerated Filer and Non‑Accelerated Filer |

Fiscal year 2024 (filed in 2025) |

Fiscal year 2025 (filed in 2026) |

| SRC |

Fiscal year 2025 (filed in 2026) |

Exempted |

| Filer Type |

Scopes 1 and 2 GHG Disclosure Compliance Date |

Limited Assurance |

Reasonable Assurance |

| Large Accelerated Filer |

Fiscal year 2023 (filed in 2024) |

Fiscal year 2024 (filed in 2025) |

Fiscal year 2026 (filed in 2027) |

| Accelerated Filer |

Fiscal year 2024 (filed in 2025) |

Fiscal year 2025 (filed in 2026) |

Fiscal year 2027 (filed in 2028) |

Source: SEC3

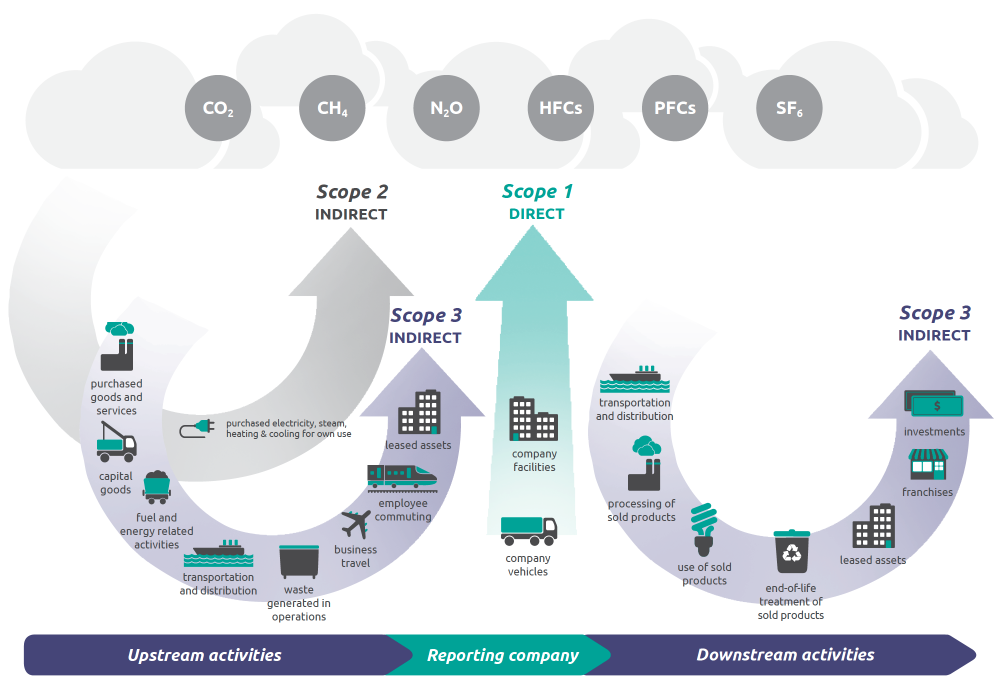

Source: EPA

4

What are Scope 1, 2, and 3 emissions?

Scope 1 emissions are direct greenhouse (GHG) emissions that occur from sources that are controlled or owned by an organization (e.g., emissions associated with fuel combustion in boilers, furnaces, vehicles).

Scope 2 emissions are indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling. Although Scope 2 emissions physically occur at the facility where they are generated, they are accounted for in an organization’s GHG inventory because they are a result of the organization’s energy use.

Scope 3 emissions are often known as value chain emissions because they represent all indirect impacts upstream and downstream of an organization that is not already captured in Scope 1 and 2 reporting. Companies measuring their Scope 3 emissions face barriers not present or as extensive when measuring Scope 1 and 2 emissions from their operations.

What do you need to do?

Apex can help you prepare for this coming regulation. While larger, public firms from a handful of sectors will be primarily impacted by this guidance, it will be important for all organizations to prepare, as diverse stakeholder groups will expect all companies to follow new best practices.

A few areas to look at now are outlined below:

Gap Assessment: Understand where your organization stands today; perform internal assessments or hire a third party to help evaluate your existing program against changing standards.

Climate Action Plan: Create a meaningful climate action plan which has been informed by gap assessments, climate scenario assessments, and global frameworks to ensure it addresses all relevant risks and opportunities.

Data Management: Inventory current data available to the decision makers. Benchmark the last fiscal year to create a baseline. Over time, this data can then inform improvements to the action plan and provide the performance data required for companies where climate is materially relevant.

Relevant Apex Offerings

- Gap assessments

- ESG materiality assessment

- Climate scenario assessment

- ESG and climate program development

- Data management, inventory, and baselining

- ESG score card and KPI development

- ESG metrics; standards setting/alignment

- Data preparedness (3rd party verification/audit preparedness)

- 3rd party data verification and audit of ESG metrics

1 https://www.sec.gov/rules/proposed/2022/33-11042.pdf

2 https://www.sec.gov/news/press-release/2022-46

3 https://www.sec.gov/files/33-11042-fact-sheet.pdf

4 https://www.epa.gov/climateleadership/scope-1-and-scope-2-inventory-guidance